Shampoos and soaps claim to come in a range of different scents, but they’re mostly fruity or flowery. This leaves guys with that basic musky […] Read More

Shampoos and soaps claim to come in a range of different scents, but they’re mostly fruity or flowery. This leaves guys with that basic musky […] Read More

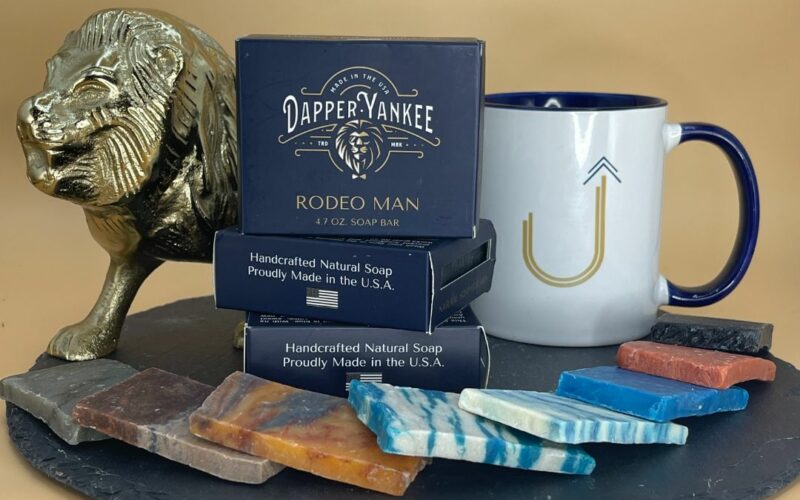

The newest arrival in the Dapper Yankee lineup has Dapper Yank fans overjoyed. A natural Dapper Yankee deodorant has finally arrived! Even if you aren’t […] Read More

If you’ve been reading my blog you may have noticed that I used to be a huge fan of Dr. Squatch. And honestly, until recently, […] Read More

There are hundreds of body cleansers out there designed for all skin types. You have your classic bar soap, bar soap with moisturizers, and bar […] Read More

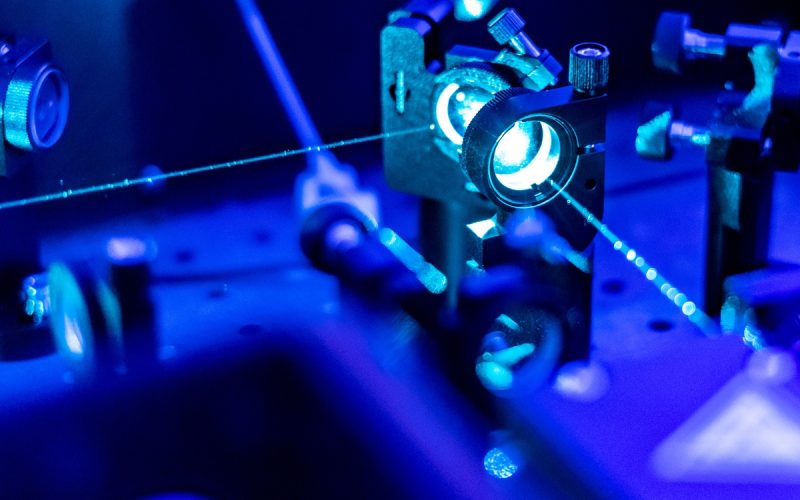

Science offers diverse career paths beyond traditional lab work. Find high-paying scientific job opportunities that match your skills and interests.

Stay safe with effective strategies for handling hazardous chemicals. Equip your team with actionable tips to ensure workplace safety and compliance today!

Do you think your roof warranty has you covered? Not so fast there, pal! Here are eight fine-print exclusions that could leave you holding the bill.

You might receive the offer for an extended warranty and decide to toss the postcard in the trash. We’re here to tell you to think twice for big purchases.

Is it time to upgrade your facility’s lighting? These tips for managing a commercial lighting upgrade project will make the process as smooth as possible.

As summer turns the corner and brings us into fall, consider upgrading your motorcycle with a few comfort and safety features. Beautiful fall rides up ahead!

Did you know laser tracking technology played a much more important role in your everyday life than you realized? Explore these fun facts to learn more.

Finding the perfect hobby to invest your time and income in is no easy task. If you work in tech, we highly recommend looking into woodworking.

Extreme heat ruins phones, cars, and household items fast. Learn what high temperatures do to your stuff and how to protect your investments.