Shampoos and soaps claim to come in a range of different scents, but they’re mostly fruity or flowery. This leaves guys with that basic musky […] Read More

Shampoos and soaps claim to come in a range of different scents, but they’re mostly fruity or flowery. This leaves guys with that basic musky […] Read More

The newest arrival in the Dapper Yankee lineup has Dapper Yank fans overjoyed. A natural Dapper Yankee deodorant has finally arrived! Even if you aren’t […] Read More

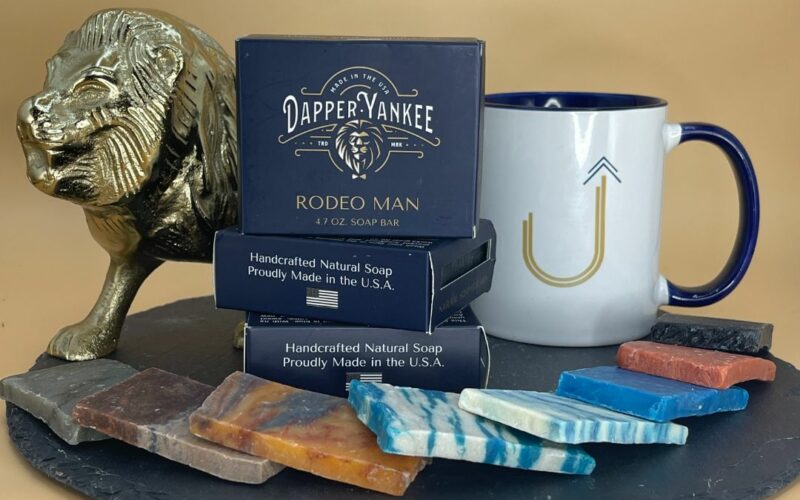

If you’ve been reading my blog you may have noticed that I used to be a huge fan of Dr. Squatch. And honestly, until recently, […] Read More

There are hundreds of body cleansers out there designed for all skin types. You have your classic bar soap, bar soap with moisturizers, and bar […] Read More

A beautiful, welcoming lobby draws your guests in and makes them feel immediately at home. Use these elegant tips for upgrading your hotel lobby.

A car wash can quickly and cheaply restore your ride’s shine, so why does the typical car detailing service cost several hundred dollars? Let’s talk about it.

Your health problems could start right at home if you’re not careful. Follow these tips to remove anything that’s harmful to your health from the house.

If you’re pushing technology to the limits in your modern business, you have some important decisions to make. Consider this advice on how to do things right.

If your friend group feels partied out, it might be time to consider a sober bachelor party. Take these ideas to heart the next time someone ties the knot.

New to power tools? Learn the four must-know tips to use these tools safely, including the anti-vibration gloves and why you should have an organized workspace.

Are pests showing up in your home? Here are the most common types of home infestations and what to do about getting rid of these pesky visitors.

Planning to live in an RV full time? Learn what to consider, including space challenges, costs, and adapting to a new routine, before hitting the road.

Learn how each season affects your roof ventilation, and discover simple tips to maintain it throughout the year for improved home efficiency.