Shampoos and soaps claim to come in a range of different scents, but they’re mostly fruity or flowery. This leaves guys with that basic musky […] Read More

Shampoos and soaps claim to come in a range of different scents, but they’re mostly fruity or flowery. This leaves guys with that basic musky […] Read More

The newest arrival in the Dapper Yankee lineup has Dapper Yank fans overjoyed. A natural Dapper Yankee deodorant has finally arrived! Even if you aren’t […] Read More

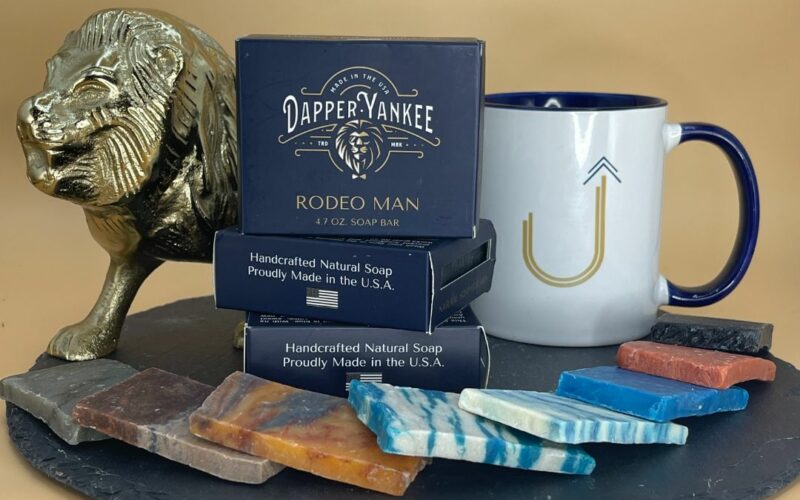

If you’ve been reading my blog you may have noticed that I used to be a huge fan of Dr. Squatch. And honestly, until recently, […] Read More

There are hundreds of body cleansers out there designed for all skin types. You have your classic bar soap, bar soap with moisturizers, and bar […] Read More

New to power tools? Learn the four must-know tips to use these tools safely, including the anti-vibration gloves and why you should have an organized workspace.

Are pests showing up in your home? Here are the most common types of home infestations and what to do about getting rid of these pesky visitors.

Planning to live in an RV full time? Learn what to consider, including space challenges, costs, and adapting to a new routine, before hitting the road.

Learn how each season affects your roof ventilation, and discover simple tips to maintain it throughout the year for improved home efficiency.

Creating anticipation for your restaurant opening is crucial for fostering an initial loyal customer base. Here are four effective strategies to implement.

Adding a wine cellar to your home is a luxury decision that must be careful with if you want it to work for your collection—here are our top considerations.

You want to have the coolest car around, but that doesn’t mean spending a fortune! Consider these budget-friendly ideas for breathing new life into your ride.

Moving an off-grid home? From prep to transport, discover what you need to know to relocate your tiny home, RV, or container safely and efficiently.

Car owners should know these 4 common maintenance mistakes. Pay attention to issues with your filter, windshield, and other elements to avoid costly repairs.